I receive a never-ending stream of investment research and news emails in my inbox. Most of them are unsolicited, and I usually ignore them. But a recent email from a respected research firm piqued my interest; it contained a 60-slide deck of fascinating economic and investment charts. The deck was fantastic, highlighting various quirks of the current state of the economy and markets compared to the past. My perusal of the slides makes me feel better informed.

But am I really? What if all the information I gained from the slide deck is counterproductive?

Too Much Information

In 1956, George Miller published one of the most famous papers in the history of psychology called: “The Magical Number Seven, Plus or Minus Two: Some Limits on Our Capacity for Processing Information.” In the paper, Dr. Miller described the phenomenon of us being able to only store five to nine items of information in our working memory (or “seven plus or minus two”). Working memory has a duration of about ten to fifteen seconds and contains information that helps us move from one thought to the next and allows us to do quick and dirty calculations. It’s where we do our thinking.

As we move through our lives, making decisions and guessing what the future holds for us, we don’t usually think about the limits of our working memory. Typically, we like to have more information, not less. This is especially true when faced with uncertainty because collecting more information is a primary strategy for battling uncertainty. But possessing more information can inflate our confidence without improving our predictive or decision-making abilities.

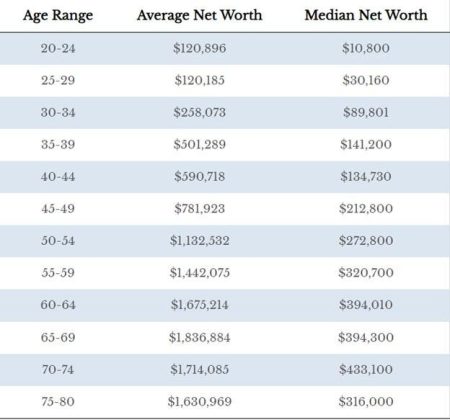

For example, researchers from the University of Chicago and the University of Toronto tested college football fans’ ability to predict the outcome of games by using differing amounts of information. In the experiment, team names were replaced with letters (e.g., Team A, Team B, etc.). In the first round, the fans were given six items of information about each team and asked to predict winners. This was repeated for a total of six rounds, but at each round, the subjects received six more items of information about the teams (i.e., in round one there were six items of information, in round two there were twelve, and so on).

How did the fans do? Pretty well. They picked winners about two-thirds of the time. However, that success rate hardly budged throughout the six trials. Having additional information didn’t give them any significant advantage. What did increase with each round, however, was their confidence in their predictions (see figure below).

The same thing happens in the investment realm. More information leads to more confidence, but after a certain point it impedes the ability to make decisions. For example, a study of venture capitalists found, “the more information about the venture provided to the [venture capitalists], the less able they were at predicting outcomes.” Multiple other studies reach this same conclusion: seeking more information is counterproductive.

How to Fight the Information Paradox

Should investors eschew all news and information and have a goal of complete ignorance? No. But drinking from a fire hose of information and drowning ourselves in data is not the answer. Here’s what you should do instead:

- Limit your consumption of financial news. You don’t need to know everything going on in the markets and economy to be a successful investor. Instead of immersing yourself in the daily torrent of news, try limiting yourself to just 10 – 15 minutes a day of news consumption. If you are a big consumer of financial information, this will be hard because we get a hit of dopamine (which signals feelings of pleasure to the brain) when we take in information, which makes our brains crave more.

- Create a latticework of mental models. Mental models are conceptual structures that help us understand how the world works. They are bits of knowledge or wisdom we file away in our heads to help us make decisions. As I write in my book, The Uncertainty Solution: How to Invest with Confidence in the Face of the Unknown, great investors create a latticework of mental models to help them make decisions. Reading books about investing is a great way to gain investment wisdom and build a latticework of investment mental models – my book contains 35 essential investment mental models. Here’s a list of good investment books for beginning investors.

- Practice humility. Realize that the information paradox applies to you and not just to other people. The more information you consume, the more confident you’ll be about what you think will happen. Yet, because of brain limitations, that additional information harms your decision-making capabilities. Always keep in mind that more information isn’t always better.

It’s hard to turn off the noise swirling around us and to focus on what matters; we’ve evolved to crave information. But by pulling back, taking a bigger-picture view, and building investment wisdom through mental models, you’ll have less worry and, ultimately, more money.

Read the full article here