Fitch Ratings, one of the leading rating agencies in the U.S. alongside Moody’s and Standard & Poor’s, just downgraded the U.S. from the top-tier AAA qualification to AA+, one notch below. This decision came after a three-month period of “negative watch” and was based on concerns related to recurring spending stand-offs, a gradual “erosion of governance,” and an increasing debt burden. Undoubtedly, these reasons hold true, as the congressional circus has focused on scoring political points and stoking cultural grievances that are irrelevant to economic management.

But what does this lower rating truly indicate? A rating’s primary purpose is to assess the likelihood of a debtor defaulting on its debt. But according to Fitch, no sovereign rated above A+ (which is three notches below AA+) has defaulted since 1995. Standard & Poor’s reports a similar track record going back to 1993. And although the U.S. Federal Government faces a higher interest rate burden due to mounting debt and rising interest rates, it remains well below the levels seen between 1982 and 1999, when the U.S. had a AAA credit rating and the stock market went up tenfold.

Borrowing has gone up, to be sure, but as a June 2023 Congressional Research Service report highlights, borrowing money is not inherently problematic as long as it contributes to economic growth or productive use. The answer here is unclear; the economy seems to be outperforming expectations (against predictions of an impending recession that has yet to materialize), but productivity figures remain dismal, perhaps due to the lingering effects of pandemic-related disruptions.

Will the downgrade have any impact on foreign purchases of U.S. debt? Quite unlikely. U.S. debt remains the preferred instrument for almost every surplus-producing country in the world. Of the $7.3 trillion owned by foreigners, Japan, China, and the U.K. hold the largest shares, with holdings split roughly evenly between governments and foreign private sectors. The unmatched liquidity and depth of U.S. Treasury securities are major factors for foreign and domestic holders to invest in U.S. debt, which this minor downgrade will not dampen in any significant way.

Most importantly, the likelihood that a country that can print its own currency could default is virtually zero—unless its money supply spirals out of control, as observed in Suriname, the only country to default on its local debt in 2021, when inflation reached a staggering 60%.

Therefore, the Fitch downgrade does not reflect a shift in the probability of a U.S. debt default due to economic deterioration. Worse conditions have existed in the past when both the economy and the stock market thrived, and there are good arguments to support the idea that the increase in debt was both necessary (during the pandemic) and a good investment (if the infrastructure bill pays off).

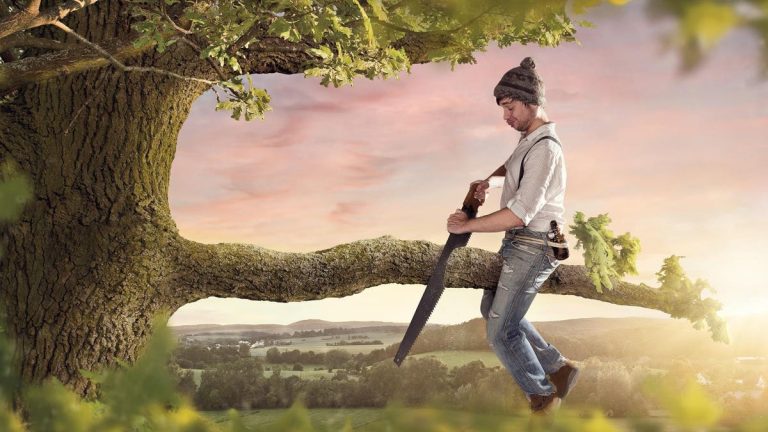

What the downgrade appears to be instead is a warning, signaling that the risk of a U.S. default has gone up not because the economy has deteriorated but because of the surge of a new political class solely focused on creating chaos and scoring ideological points, even if it risks causing irreversible damage to the nation and global economy. In this sense, the U.S. Congress resembles someone with access to a nuclear launch button, capable of causing widespread devastation not just to others but also itself. Fitch seems to believe that this newly emerged political class possesses enough influence that the possibility of triggering such a scenario is not insignificant.

The market, for now, seems hesitant to accept this as a likely outcome, echoing the impact of the 2011 downgrade by Standard & Poor’s for similar reasons and which had few long-term repercussions. Naturally, this is what every investor wants and any rational person hopes for. Still, we have now been warned, twice, that the U.S. credit is not what it used to be, and the reason for that is not the economy.

Read the full article here