Entrepreneur

Key Takeaways

- Build for decades, not funding rounds, and value compounds through patience.

- Long-term leadership beats speed when infrastructure and materials are the mission.

If you had told me back in high school that I’d one day commit my life to rebuilding American industrial capacity, I wouldn’t have believed you, but I can still remember the day my economics teacher, Mr. Thorn, explained a principle that changed how I see the world: demand grows exponentially, while supply, especially for physical materials, grows linearly.

That lesson hit me harder than anything else I learned in school. It made me realize that as the global population grows and technology accelerates, the pressure on real-world materials will only intensify. And nowhere is that more evident than in copper, the metal that powers modern civilization.

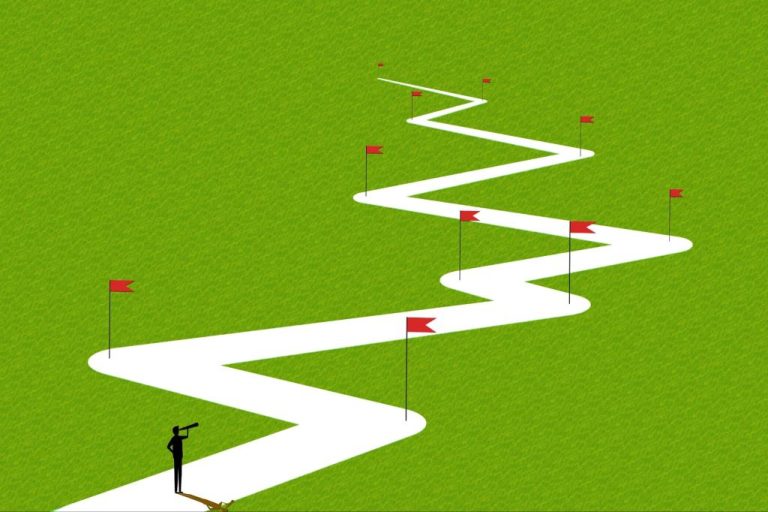

It was clear to me even as a teenager that the future would belong to those who build for the long term, not for the next funding round. Now, decades later, my company is focused on building infrastructure that will benefit the next generation.

If you follow the news, you’ve likely heard about the global race to secure critical minerals. In our case, we’re focused on copper, the mineral that helps power everything from our cellphones to our electric vehicles, AI data centers and national defense systems.

Humans have produced about 700 million tonnes of copper throughout history. Yet analysts now estimate we’ll need to mine another 700 million tonnes over just the next two decades to maintain moderate global GDP growth, according to S&P Global.

It’s the kind of work that doesn’t follow the usual startup script. Most founders are taught to focus on speed, raise money, and scale fast before hitting the next milestone. But when you’re committed to building something that delivers value for generations, you don’t just chase momentum, you plan to leave a legacy.

Here’s what a high-school economics lesson, a global mining career and years spent in Japan taught me about creating value that lasts.

Related: Make This Counterintuitive Move to Become a More Effective Leader

The Japanese blueprint for long-term leadership

When I first arrived in Japan as a young professional, I thought I was there to sharpen my legal and business skills, but what I gained went far beyond contracts and closings. Through years of studying, working and living in the country, I came to see that long-term leadership isn’t just a business strategy, it’s a way of life.

Through mentors, colleagues and cultural immersion, I learned the value of makoto, sincerity and integrity in all dealings; samurai spirit, discipline, perseverance and honor; gi, doing what’s right regardless of convenience; and kokorozashi, pursuing a purpose greater than oneself. These principles shaped how I lead more than any startup playbook ever could.

These principles shaped the way I lead far more than any startup playbook. They stand in stark contrast to the “speed at all costs” mentality that dominates today’s entrepreneurial landscape. In a business culture often defined by rapid scaling and short-term wins, the Japanese approach to business offers a powerful counterpoint.

According to PwC’s 2024 CEO Survey, 45% of global leaders are now prioritizing long-term transformation over immediate results. Living in Japan taught me what the best founders eventually learn, that legacy is built in decades, not quarters.

Founders who win the long game understand one thing

In the early stages of a company, founders often get caught up in one of two traps: prioritizing optics over substance or focusing entirely on execution, while leaving stakeholders in the dark. I’ve seen both extremes. Some founders focus so much on optics that they end up pitching progress that doesn’t exist. Others stay heads down in the work, leaving investors and partners unsure if anything is moving forward.

Neither approach works on its own. Founders who last understand that execution matters, but so does communication. The real challenge, and opportunity, lies in balancing both.

A recent McKinsey study found that companies grounding their external communication in a long-term strategy build more trust and consistently outperform peers. Investors and stakeholders want vision, but they also want tangible evidence that the vision is real.

Legacy companies get this right. They focus on fundamentals, communicate with clarity and avoid overpromising. Founders building for the long haul know their job is not just to deliver results, but to articulate how and why those results matter.

That clarity is what separates hype-driven startups from enduring enterprises, and it’s what keeps investors, teams and partners aligned for the journey ahead.

Related: Turn Your Startup Into a Scalable, Sustainable Business — Wherever You Are

Forget the growth hacks, grit is what really builds a legacy

We live in a world obsessed with shortcuts and growth hacks, but anyone who has built something meaningful knows there are none. Building a legacy company requires grit, or what the Japanese call konjō.

It’s about showing up when no one’s watching, taking the harder road because it’s the right one, and choosing long-term discipline over short-term gratification. It also means understanding that no amount of optics can replace actual results.

A 2024 article from Harvard Business Review found that founders who succeed over the long haul score significantly higher on perseverance and consistent execution than on pedigree, early funding, or luck.

The world doesn’t owe you anything. If you want to build something that outlives you, you have to earn it. That means showing up every day, doing the work and never assuming the value of what you’re building will speak for itself.

In my own work, we aren’t just building a company, we’re helping reimagine what American industry can be in an era defined by resource scarcity, geopolitical competition and raw-material bottlenecks. This kind of mission can’t be accomplished by chasing quick profits. It demands a different mindset.

There’s a Japanese proverb that says, “sit on a stone for three years,” which means eventually even the coldest stone will warm with enough patience and commitment. Founders who embrace that will define the next century, not because they scaled the fastest, but because they built a company that endures. When you build with integrity, discipline and a vision for the future, you’re not just launching a business; you’re building a legacy.

Key Takeaways

- Build for decades, not funding rounds, and value compounds through patience.

- Long-term leadership beats speed when infrastructure and materials are the mission.

If you had told me back in high school that I’d one day commit my life to rebuilding American industrial capacity, I wouldn’t have believed you, but I can still remember the day my economics teacher, Mr. Thorn, explained a principle that changed how I see the world: demand grows exponentially, while supply, especially for physical materials, grows linearly.

That lesson hit me harder than anything else I learned in school. It made me realize that as the global population grows and technology accelerates, the pressure on real-world materials will only intensify. And nowhere is that more evident than in copper, the metal that powers modern civilization.

It was clear to me even as a teenager that the future would belong to those who build for the long term, not for the next funding round. Now, decades later, my company is focused on building infrastructure that will benefit the next generation.

If you follow the news, you’ve likely heard about the global race to secure critical minerals. In our case, we’re focused on copper, the mineral that helps power everything from our cellphones to our electric vehicles, AI data centers and national defense systems.

Humans have produced about 700 million tonnes of copper throughout history. Yet analysts now estimate we’ll need to mine another 700 million tonnes over just the next two decades to maintain moderate global GDP growth, according to S&P Global.

It’s the kind of work that doesn’t follow the usual startup script. Most founders are taught to focus on speed, raise money, and scale fast before hitting the next milestone. But when you’re committed to building something that delivers value for generations, you don’t just chase momentum, you plan to leave a legacy.

Here’s what a high-school economics lesson, a global mining career and years spent in Japan taught me about creating value that lasts.

The rest of this article is locked.

Join Entrepreneur+ today for access.

Read the full article here