The IRS recently announced that the amount individuals can contribute to their 401(k) plans in 2024 has increased and catch-up contributions are getting a minor tweak.

“Tax-advantaged retirement accounts allow investors’ assets to grow without the tax friction experienced in typical brokerage accounts. It’s much like a track race,” Jonathan Lee, senior portfolio manager, U.S. Bank Wealth Management, told FOX Business. “In this example, your contribution is the runner. Taxes on capital gains and dividends are hurdles to finishing the race (reaching the retirement savings goal) within a desired time frame. Tax-advantaged accounts eliminate those hurdles in saving for retirement.”

LIVING PAYCHECK TO PAYCHECK IS THE NEW NORM

He explains that the 50-plus demographic has the added benefit of contributing more of their money to tax-advantaged accounts as retirement gets closer.

Catch-up provisions can be advantageous for those ages 50+

According to Lee, to quantify the “catch-up” benefit for an IRA, the additional $1,000, contributed annually, growing at an assumed 7% rate year-over-year, results in an additional $5,750.73 of retirement savings at the end of a five-year period, an additional $13,816.45 of retirement savings at the end of a 10-year period, and an additional $25,129.02 of retirement savings at the end of a 15-year period.

Many retirement accounts benchmarked to the S&P 500 could net a bit more. On average, the the broadest measure of the stock market has returned 10% annually.

CLAIM THAT SPEAKER JOHNSON LIVES PAYCHECK TO PAYCHECK MAKES HIM RELATABLE, SAY DEFENDERS

Furthermore, investors in this demographic may have reached a point in life where other financial goals have been achieved, i.e. supporting children through college or paying off a mortgage, Lee told FOX Business. “An additional $1,000 of their newfound savings can work on their behalf as a catch-up contribution to their IRA,” adds Lee.

IRS UPDATES NEW TAX BRACKETS, STANDARD DEDUCTIONS

How catch-up contributions can help you lower your taxes

Lee reports that additional pre-tax contributions to your workplace savings plan or tax-deductible contributions to an IRA can mean less taxable income. “The more you add, the lower your tax bill could be in the year the contributions are made or attributed,” he says.

Your spouse and the new provision

According to Lee, the IRS permits a spouse who does not earn income to fund an individual retirement account, provided they file a joint tax return with the spouse who does earn income. “Each spouse would have their own IRAs,” Lee told FOX Business. The IRA belonging to the spouse who does not earn income is “nicknamed” a “Spousal IRA.” “The same annual contribution limits apply to Spousal IRAs as any other IRA, meaning non-working spouses will be able to save more in 2024 as well,” he adds.

Why the ‘50s’ decade matters

Typically, people in their 50s will be working another seven to 15 years, said Emily Irwin, senior director of advice and planning for Wells Fargo, who is based in Minneapolis, Minnesota, in a time that is also usually the highest earning years. “By taking advantage of catch-up contributions, you can save while leveraging compound interest,” she explains. For example, if you start contributing the maximum annual contribution at age 50 and you retire at age 65, it’s possible that you can double or even triple your investment, Irwin told FOX Business.

IRS

Published Nov. 9, 2023 3:17pm EST

IRS sets new tax brackets, standard deduction for 2024

IRS adjusts tax brackets by 5.4% amid still-high inflation

By Megan Henney FOXBusiness

close

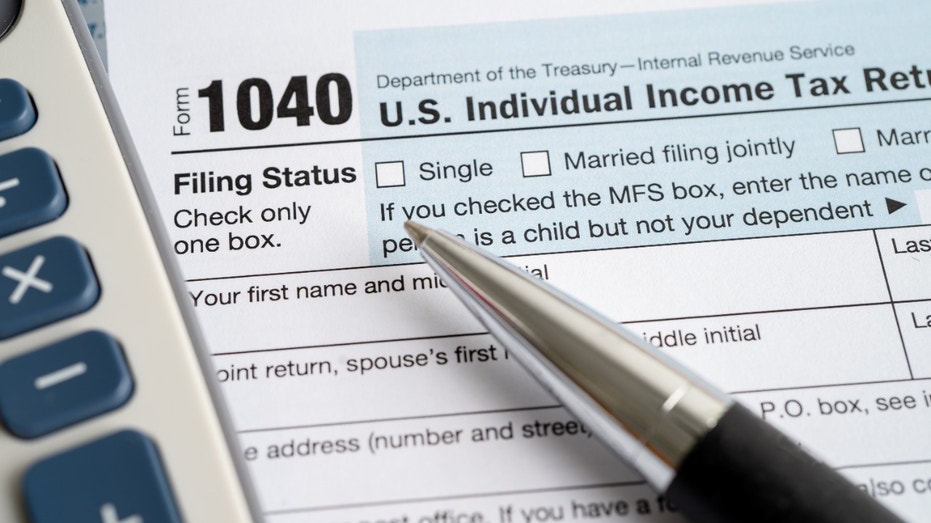

The IRS on Thursday announced higher inflation adjustments for the 2024 tax year, potentially giving Americans a chance to increase their take-home pay next year.

The higher limits for the federal income tax bracket and standard deductions are intended to avoid a phenomenon known as “bracket creep,” which happens when taxpayers are pushed into higher-income brackets even though their purchasing power is essentially unchanged due to high inflation.

The IRS makes such adjustments annually, but in times of inflation, the increases are more significant and impactful for taxpayers.

This year, the tax brackets are shifting higher by about 5.4%.

The higher thresholds where tax rates take effect could mean savings for millions of workers across all income brackets.

IRS PLANS TO TEST FREE TAX-FILING PILOT PROGRAM IN 13 STATES NEXT YEAR

Here are the changes unveiled by the IRS. The inflation-adjusted elements will apply to the 2024 tax year, meaning returns filed in 2025.

Standard deduction

The standard deduction, which reduces the amount of income you must pay taxes on, is claimed by a majority of taxpayers.

It will rise to $29,200, up from $27,700 in 2024 for married couples filing jointly, amounting to a 5.4% bump. For individuals, the new maximum will be $14,600 for 2024, up from $13,850, the IRS said.

Heads of households will see their standard deduction jump to $21,900 in 2024, up from $20,800.

Tax brackets for single individuals:

The IRS is increasing the tax brackets by about 5.4% for both individual and married filers across the different income spectrums. The top tax rate remains 37% in 2024.

- 10%: Taxable income up to $11,600

- 12%: Taxable income over $11,600

- 22%: Taxable income over $47,150

- 24%: Taxable income over $100,525

- 32%: Taxable income over $191,950

- 35%: Taxable income over $243,725

- 37%: Taxable income over $609,350

YELLEN SAYS REPUBLICAN CUTS TO IRS FUNDING WOULD BE ‘DAMAGING AND IRRESPONSIBLE’

Tax brackets for joint filers:

- 10%: Taxable income up to $23,200

- 12%: Taxable income over $23,200

- 22%: Taxable income over $94,300

- 24%: Taxable income over $201,050

- 32%: Taxable income over $383,900

- 35%: Taxable income over $487,450

- 37%: Taxable income over $731,200

Other tax provisions

Another tip, she says, is that a person can automate your contributions. “So, essentially, you can ‘set it and forget it.’ This gives you peace of mind that you’re paying yourself first and prioritizing your retirement,” adds Erwin. And, finally, determine if your employer matches catch-up contributions. “If so, you’ll want to leverage that benefit,” Erwin continued.

Read the full article here