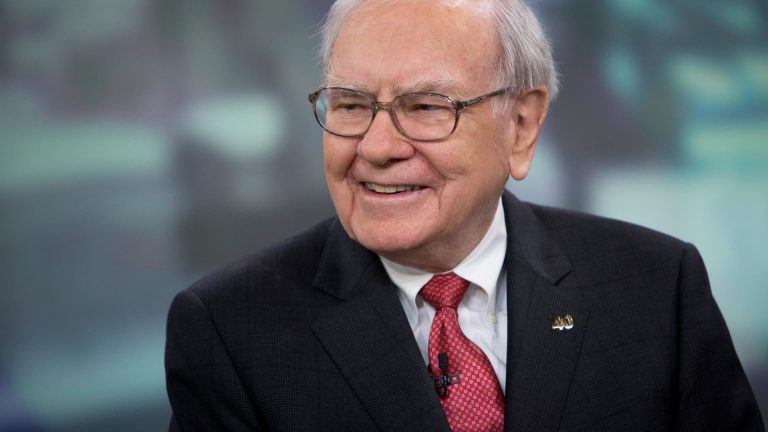

The stock market tumbled into correction territory this week, spurring fear among investors that more turmoil is ahead. But if you are a disciple of Warren Buffett, a 10% drawdown for the equity benchmark shouldn’t matter. The S & P 500 is in the middle of a third straight down month, sliding 10% from its peak in July to meet the traditional definition of a correction. The market has been grappling with surging bonds yields and the war in the Middle East, while the latest earnings season has been underwhelming at best, further denting investors’ risk appetite. Still, Buffett, who at Columbia University studied under Benjamin Graham , the fabled father of value investing, thinks the average investor should only focus on the long term, ignoring any turbulence in the broader market and avoiding panic selling. “I know what markets are going to do over a long period of time — They’re gonna go up. But in terms of what’s going to happen in a day, or a week, or a month, or a year even, I never felt that I knew it, and I’ve never felt that was important,” Buffett said in a CNBC interview in 2016. “I will say that in 10 or 20 or 30 years, I think stocks will be a lot higher than they are now.” The Berkshire Hathaway CEO likes to view his stock holdings as small pieces of businesses. Before the Oracle of Omaha buys a stock, he seeks to grasp the intrinsic value of an asset, which is the discounted value today of the cash that a business generates in the future. Buffett believes that when there’s emotional selling in the market, it offers an opportunity for him to hunt for bargains. “Anytime stocks go down as far as I’m concerned, I like it because I’m a net buyer of stocks,” he said. “I’ve been buying stocks ever since I was 11 years old. So when stocks go down, it’s good news. Just like when hamburgers go down, it’s good news or Coca-Cola.” The country will grow in value over time Buffett’s conglomerate Berkshire owns a vast array of well-established businesses, ranging from Geico insurance to BNSF Railway. The juggernaut now owns the biggest amount of U.S. assets (property, plant and equipment) by value than any other company in the country. The investing icon remains a firm believer in the American dream, and even in the gloomiest days of the Covid pandemic, Buffett reminded investors to “never bet against America. ” “American business will do well over time and just take the 20th century. Stocks went from 66 the Dow Average 66 to 11,497,” Buffett said. “You had two world wars and you had a great depression, flu epidemics, all kinds of things. American business will do fine over time … the only person that can cause you to get a bad result in stocks is yourself.” Buffett bought his very first stock — Cities Service Preferred — when he was 11. He recalled that the attack on Pearl Harbor had just happened a few months prior. Throughout his career, he has taken advantage of lower prices during times of crisis. “The country’s not gonna go away. The plants aren’t gonna go away. The people aren’t gonna go away. The talents aren’t gonna go away. The country will grow in value over time,” Buffett said. “It’s a terrible mistake to buy or sell stocks based on what you think businesses are going to do next month or next, even next year.”

Read the full article here