August retail sales on Thursday are expected to slow significantly from last month’s pace. With the U.S. consumer critical to the health of the overall economy and GDP growth, will this be the beginning of the end or the pause that refreshes?

As one would expect, job growth significantly impacts the direction of retail sales. When American consumers have money to spend, they typically do so. While job growth looks to be slowing, there are no signs of a steep decline on the horizon.

Indeed, the recent increase in unemployment was a healthy increase in the labor force rather than a decline in employment. This development increased hopes that wage growth can moderate due to the added supply of labor rather than a reduction in demand for workers, which accompanies an economic slowdown. Even with the unemployment rate rising to 3.8%, that remains a very low reading.

While the increase in gasoline prices should lift the gas station component of retail sales, it typically weighs on other possible purchases. In addition, vehicle sales have declined, which will dent the headline consumer spending reading.

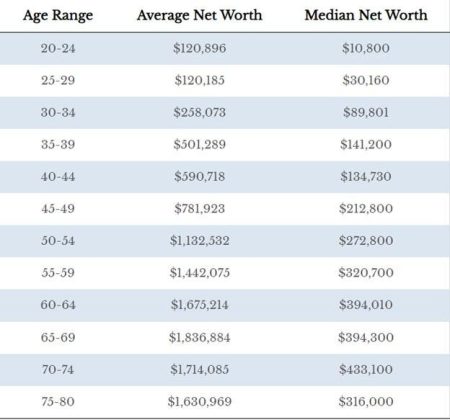

In addition to job growth, the record level of the U.S. household net worth report last week should support the health of the consumer. Household net worth grew $5.5 trillion to a record high of $154.3 trillion for the second quarter.

Credit card delinquencies have risen from the lows, but so far, they are normalizing rather than moving to troublesome levels. While the increase in delinquencies remains benign, this trend should be monitored for any signs of accelerated deterioration.

One area of concern is auto loan delinquencies, which have risen past pre-pandemic levels. Some of this weakness is attributable to the impact of the pandemic, as auto prices soared but are now declining.

While Thursday’s retail sales report is likely to reflect slowing spending from the U.S. consumer and cause a moderation in some estimates of third-quarter GDP growth, the economy should grow at an above-trend rate for the quarter. The probability of a recession in 2023 remains very low. In addition, other data support the view that retail spending will likely continue after this pause. A few headwinds to watch are gasoline prices, auto loans, and the impact of the resumption in student loan repayments.

Read the full article here