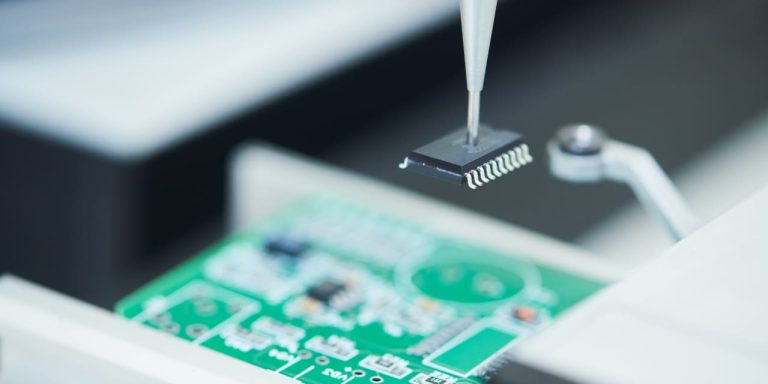

Arm’s technology powers chips inside nearly every smartphone.

Dreamstime

Arm Holdings is set for a blockbuster initial public offering which will test market appetite for an important technology company. However, its targeted valuation suggests it is accepting it won’t be the next

Nvidia.

British chip designer Arm is eyeing a valuation between $50 billion and $55 billion for its IPO on the Nasdaq, according to The Wall Street Journal, citing people familiar with the matter.

Arm declined to comment when contacted by Barron’s.

The target is below a $64 billion calculation of Arm’s value following a recent stake sale involving its current owner SoftBank (ticker: 9984.Japan). SoftBank is hoping to sell about 10% of total shares outstanding in the offering, The Journal reported.

However, it would still make it the biggest IPO of the year and an important marker for investor interest in a major technology company listing at a time of high interest rates. The valuation still suggests Arm is pretty optimistic.

Arm generated $2.68 billion of revenue in its most recent fiscal year and net income of $524 million. That indicates it is looking for a trailing price-to-earnings multiple of between 95 and 105 times.

That’s less than the 117 times trailing price-to-earnings ratio which Nvidia (NVDA) trades. However, Arm is still aiming for a hefty premium to other chip makers which share a heavy exposure to the sluggish smartphone market. For example, Qualcomm (QCOM) trades at a trailing P/E ratio of 15 times.

A backward-looking valuation doesn’t tell the full story. Arm’s technology powers chips inside nearly every smartphone and it’s hoping that several of its partners will invest in its IPO as strategic investors. Nvidia,

Apple

(AAPL) and Google-parent

Alphabet

(GOOGL) are all among the companies signed up to invest, according to Reuters. That could push up the valuation.

However, what makes sense as a strategic investment for Arm’s customers might not make sense for individual investors. Arm’s exposure to smartphones and the Chinese market have raised questions among analysts about its growth trajectory.

“Our experts are skeptical about the long-term sustainability of revenue growth and high margins of ARM. They expect a yearly revenue growth of 5-10% for the next five years, followed by a peak and subsequent contraction on a yearly basis,” wrote Albie Amankona, an analyst at Third Bridge in a research note on Monday.

Write to Adam Clark at [email protected]

Read the full article here